Quest Store Revenue Distribution

With 124 Quest apps exceeding $1 million, that means that roughly 36% of apps on the Quest store have earned more than $1 million, which I take to mean that Meta is making fairly good decisions about which apps are going to perform well in the store if we measure ‘success’ by the $1 million milestone. For reference, $1 million at the most common Quest app price of $20 is 50,000 units sold.

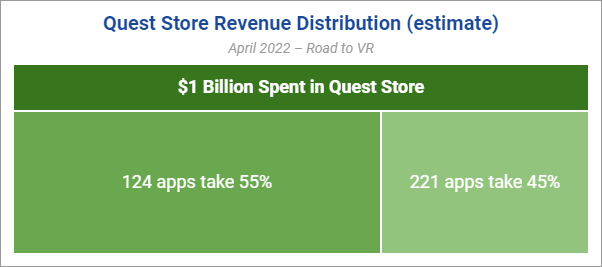

If we take the latest data shared by Meta at face value (ie: we assume all the apps in the $1 million bucket have made exactly that much, all the apps in the $2 million bucket have made exactly that much, etc), we can conclude that about 55% of the $1 billion Meta says was spent in the Quest store has gone to these 124 apps.

And we know for a fact that games like Beat Saber have made far more than the top $20 million bucket of data that Meta has shared. So that means even more than 55% of all the store’s revenue is going to just 124 (36%) of Quest apps.

And we know for a fact that games like Beat Saber have made far more than the top $20 million bucket of data that Meta has shared. So that means even more than 55% of all the store’s revenue is going to just 124 (36%) of Quest apps.

This isn’t an unexpected outcome, after all, gaming generally tends to be a hits-driven business, but it does make one wonder why a smaller number of apps are running away with the bulk of the earnings, especially when Meta is hand-picking which apps are allowed onto the Quest store. Is it that only a small number of games on the store are actually good, or are other factors causing certain games to snowball in success (like how they are promoted in the store)? Tough to say.

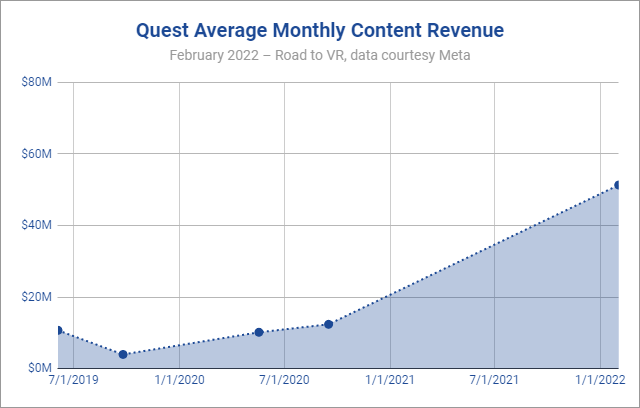

As for how overall revenue spent in the Quest store is changing over time, there’s been considerable growth since the launch of Quest 2.

Unfortunately it’s difficult to say how much of this growth in spending on the Quest store is due purely to new customers joining the ecosystem vs. an increase in the average spend of each customer (though the former is almost certainly the largest factor).

Quest Apps Earning the Most Revenue

One thing we can get a good handle on though is which apps in particular are finding the most success on the store. The number of reviews is a fairly good corollary for unit sales (not accounting for DLC); looking at Quest games that way gives us this list of the 20 most reviewed titles on the platform.

| Name | Number of Ratings | Days on Quest Store | Previously Released |

| Beat Saber | 42,173 | 1,056 | Yes |

| SUPERHOT VR | 15,869 | 1,056 | Yes |

| The Walking Dead: Saints & Sinners | 14,815 | 545 | Yes |

| Vader Immortal: Episode I | 13,902 | 1,056 | No |

| Blade & Sorcery: Nomad | 13,152 | 158 | Yes |

| Onward | 12,617 | 620 | Yes |

| Job Simulator | 10,848 | 1,056 | Yes |

| The Room VR: A Dark Matter | 10,509 | 746 | No |

| POPULATION: ONE | 10,286 | 536 | No |

| Five Nights at Freddy’s: Help Wanted | 9,608 | 634 | No |

| The Thrill of the Fight | 8,666 | 900 | Yes |

| Pistol Whip | 8,270 | 886 | No |

| Resident Evil 4 | 7,865 | 172 | No |

| Eleven Table Tennis | 7,084 | 552 | Yes |

| Walkabout Mini Golf | 6,356 | 564 | No |

| GORN | 6,287 | 428 | Yes |

| Vader Immortal: Episode III | 5,783 | 872 | No |

| Moss | 5,635 | 1,056 | Yes |

| Virtual Desktop | 5,617 | 1,056 | Yes |

| Arizona Sunshine | 5,529 | 858 | Yes |

There’s some interesting trends to see here:

- 30% are launch-day titles (1,056 days on the store dates back to Quest’s launch)

- 60% were previously released on another VR platform

- Number of days on the Quest store is (understandably) a strong predictor of being on this list, with only two notable exceptions:

- Blade & Sorcery: Nomad (158 days on store)

- Resident Evil 4 (172 days on store)

– – — – –

Interested in more data dives? Three articles worth a look: