Virtual Reality Headsets have not sold as many units as some of the more optimistic analysts have predicted, and VR Fund’s Tipatat Chennavasin says that the relatively quick adoption of smartphone technologies have spoiled a lot of people within the investment community. But despite the adoption being slower than some had hoped, Chennavasin still sees a lot of optimistic indicators for the long-term investment of companies that are driving the evolution of the medium in different industry verticals.

Virtual Reality Headsets have not sold as many units as some of the more optimistic analysts have predicted, and VR Fund’s Tipatat Chennavasin says that the relatively quick adoption of smartphone technologies have spoiled a lot of people within the investment community. But despite the adoption being slower than some had hoped, Chennavasin still sees a lot of optimistic indicators for the long-term investment of companies that are driving the evolution of the medium in different industry verticals.

LISTEN TO THE VOICES OF VR PODCAST

Audio PlayerSome of those indicators are a Magid Insights survey that found that a majority of VR consumers “very satisfied” and say product performance exceeds expectations, that there are at least 30 VR games on Steam that have grossed more than $250,000, and that there are a number of enterprise VR companies with revenues between half a million to a million dollars.

I caught up with Chennavasin at the Silicon Virtual Reality Conference on March 31st to talk about the state of the VR ecosystem. We talked about how he sees Chinese investors could be shifting focus to AI and local Chinese companies, the market challenges for educational VR companies, and why he thinks that the lack of revenue in the 360 video could bring a reckoning moment for 360 video technology and content companies.

After traveling to 36 VR conferences over the past year and seeing over 2,000 VR demos, Chennavasin sees some of the most promising VR industry verticals as being healthcare, advertising technology, collaborative meeting and product design apps, enterprise applications, as well as architecture, engineering, and construction. He’s been advising companies try to create applications that could only be done in VR, and that if you build something of value then you can find a way to get someone to pay you for it.

He provides some updates on some of VR Fund’s investments including Owlchemy Labs (which was acquired by Google in May), Against Gravity’s Rec Room, Vivid Vision, and InstaVR. He’s seeing enough positive indicators form his portfolio companies to continue making strategic investments in the VR ecosystem for the long-term path towards more ubiquitous adoption.

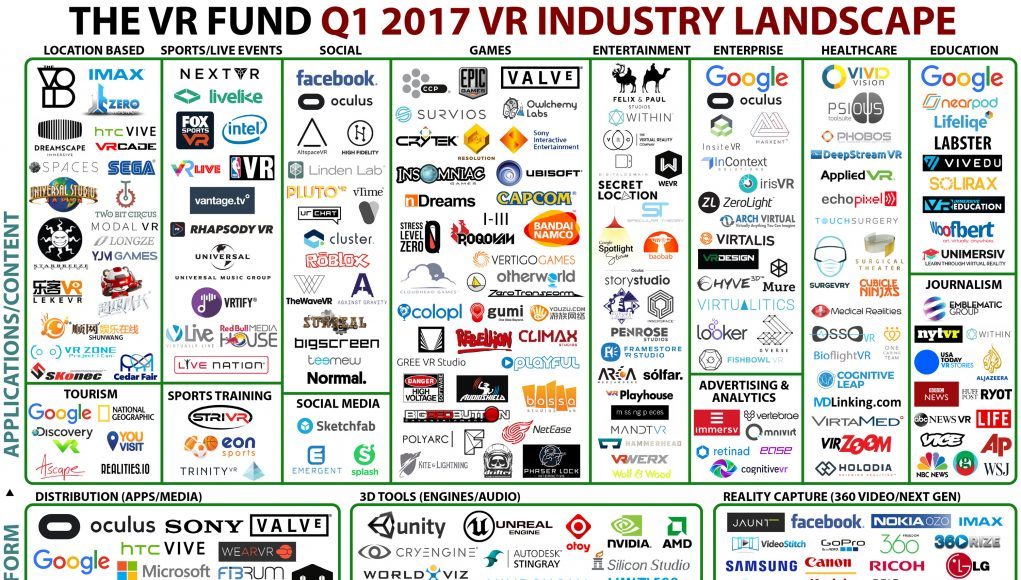

Here's the latest #VR landscape hot off the press: The number of VR companies grew 40% in 2016 https://t.co/RwzYWC5Jd0 via @VentureBeat

— tipatat (@tipatat) March 9, 2017

Support Voices of VR

- Subscribe on iTunes

- Donate to the Voices of VR Podcast Patreon

Music: Fatality & Summer Trip