Survios, a veteran VR game developer, shared fresh insights into the health of the company’s out-of-home business activities, a sector of the VR industry which has been increasingly heating up in the last 18 months.

While the consumer VR space is still waiting for its inflection moment, 2018 has seen increasing interest in both VR enterprise and commercial sectors. VR Location-based entertainment (LBE), as the commercial out-of-home VR sector is called, is largely divided into two major categories: ‘VR attractions’, bespoke and novel VR experiences that are infeasible in the home for size or cost reasons (like The VOID), and ‘VR arcades’, which more-or-less offer pay-per-use VR experiences that harness consumer-grade hardware and software.

Survios, the veteran VR game developer behind titles like Sprint Vector (2018) and Creed: Rise to Glory (2018), has in recent years been steadily expanding into the VR arcade space. The company owns and operates its own VR arcade location in Los Angeles, licenses its own content for use in other VR arcades, and acts as a publisher of third-party content.

Last week at VRX 2018 in San Francisco, Survio’s Co-head of Marketing, Hunter Kitagawa, took to the stage to share lessons the company has learned from its LBE VR deployments, and offered a look at the traction the company has seen year over year.

This time last year Survios’ VR arcade content was in 200 locations across 36 countries. This year that number has grew to 500 locations across 42 counties. In terms of content licenses sold, Survios jumped from 2,000 one year ago to 12,000 today. None of those figures include China, Kitagawa said, where the company has since announced a joint venture with Chinese tech giant NetEase to bring the company’s VR content to China.

Survios expects the growth in their VR arcade business to continue to grow through 2019, and possibly trend even further upward.

Survios expects the growth in their VR arcade business to continue to grow through 2019, and possibly trend even further upward.

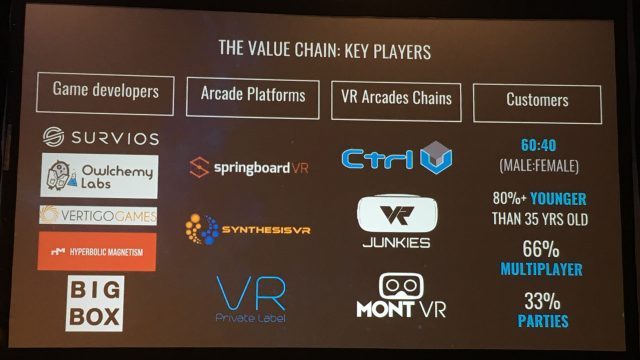

As the VR arcade sector has grown, Kitagawa offered a simplified look at the sector’s value chain, breaking the space down into ‘game developers’, ‘arcade platforms’, ‘VR arcade chains’, and ‘customers’.

He also identified a handful of key players therein, citing Survios, Vertigo Games, Beat Games, and Big Box VR among top VR arcade game developers; SpringboardVR, Synthesis VR, and Private Label VR as top VR arcade platforms; as well as Ctrl V, VR Junkies, and MontVR as top VR arcade chains.

He also identified a handful of key players therein, citing Survios, Vertigo Games, Beat Games, and Big Box VR among top VR arcade game developers; SpringboardVR, Synthesis VR, and Private Label VR as top VR arcade platforms; as well as Ctrl V, VR Junkies, and MontVR as top VR arcade chains.

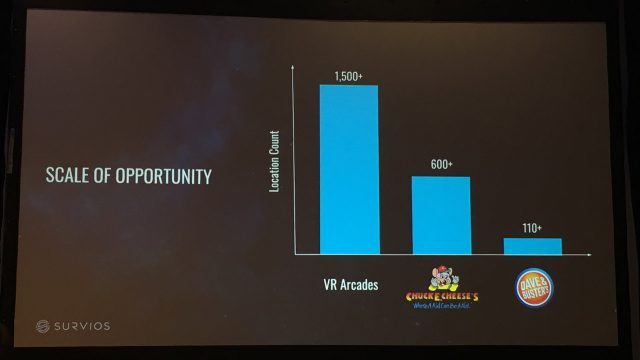

Kitagawa said that Survios reaches 10 times as many people through its VR arcade business compared to its in-home content. He compared the ‘scale of opportunity’ of VR arcades by contrasting the number of VR arcade locations against major US location-based entertainment chains Chuck E. Cheese’s and Dave & Buster’s, claiming that there are 1,500 VR arcades in operation against some 600 and 110 locations, respectively, of the aforementioned.

Among paying customers going to VR arcades, Survios has found that the demographic is more balanced between male and female (60:40) compared to in-home VR which leans more male. 80% of Suvrios’ VR arcade customers are younger than 35 years old, and 66% are playing multi-user content, Kitagawa said. Meanwhile, 33% of customers come to VR arcades as ‘parties’: group scenarios like birthdays and corporate events.

Among paying customers going to VR arcades, Survios has found that the demographic is more balanced between male and female (60:40) compared to in-home VR which leans more male. 80% of Suvrios’ VR arcade customers are younger than 35 years old, and 66% are playing multi-user content, Kitagawa said. Meanwhile, 33% of customers come to VR arcades as ‘parties’: group scenarios like birthdays and corporate events.

When it comes to content performance, Kitagawa shared a few lessons.

“You have 30 seconds or less to onboard players,” he said. With player sessions lasting only 30 minutes or so in many cases, users need to start having fun right away if they’re going to be compelling to come back.

He also advised that developers and VR arcades leverage recognizable intellectual property to bring customers in the door. With Survios’ VR title Creed: Rise to Glory, the company found that appealing to the fantasy of being part of the Creed universe was a more potent marketing message than the common approach of showing imagery of people in VR headsets.”Don’t sell VR,” he stressed.