Samsung, Google, and Qualcomm Collaborating an XR Device

The News

In early 2023 Samsung formally announced that it was collaborating with Google and Qualcomm to build some kind of XR device, but revealed no additional details.

What it Means for 2024

We still don’t know exactly what Samsung and Google are building, but there are signs that the device will be revealed (if not launched) in 2024. This marks a re-entrance into XR for both Samsung and Google.

Back in 2015 Samsung worked with Meta (at the time, Facebook’s Oculus division) to launch what was technically the company’s first consumer headset, Gear VR. The mobile-phone based headset saw several iterations over the years and reportedly moved millions of units, but for a wide range of reasons people didn’t continue to use the headsets and Samsung and Oculus abandoned the phone-based form-factor. Samsung was also one of a handful of hardware makers to build a Windows Mixed Reality headset in collaboration with Microsoft. But that venture was eventually disbanded.

Google was also pretty early in the XR space and in 2016 launched its own phone-based VR headset, Daydream View. Similar to Samsung, the device saw a few iterations but usage didn’t persist and Google abandoned the effort in 2019. Google also acquired key early PC VR studios—those behind Job Simulator and Tilt Brush—and even launched a PC VR version of Google Earth. All of which have been left to wither except for Owlchemy Labs, the Job Simulator studio, which continues to make VR games today.

Given this string of abandoned XR attempts, we can be sure that both Samsung and Google would not be re-entering this space lightly.

Very likely the move itself and the timing is a somewhat forced effort to try to keep Apple from taking an early foothold over Android in the XR space. The big question on my mind is if Samsung and Google have internalized their prior missteps, or if that knowledge has been scattered as past XR projects were abandoned?

Microsoft Officially Abandoning Windows VR

The News

Microsoft announced that it plans to remove support for its entire WMR platform on Windows, which will make Windows VR headsets incompatible with future versions of Windows.

What it Means for 2024

Just as rivals Samsung, Google, and Apple are all jumping into XR, Microsoft is dropping out. At least that’s the case for its Windows Mixed Reality platform.

Since the company announced that Windows Mixed Reality will be deprecated, we’ve learned that Windows Mixed Reality and Windows VR headsets will continue to work at least until late 2026 for consumers and late 2027 for enterprise customers. At which point Windows Mixed Reality software will no longer be available for download. That will mean Windows VR headsets that are already set up will remain functional (though officially unsupported) until users update to a version of Windows that doesn’t include Windows Mixed Reality.

Considering that Windows Mixed Reality headsets make up only about 5% of the PC VR market and they will continue to work normally until late 2026, the impact for 2024 will be minimal.

As Windows VR is left to wither, it remains to be seen if Microsoft will press ahead with HoloLens 2 or eventually abandon that platform as well.

Meta VR Content Revenue Slows as it Continues to Invest Billions in XR

The News

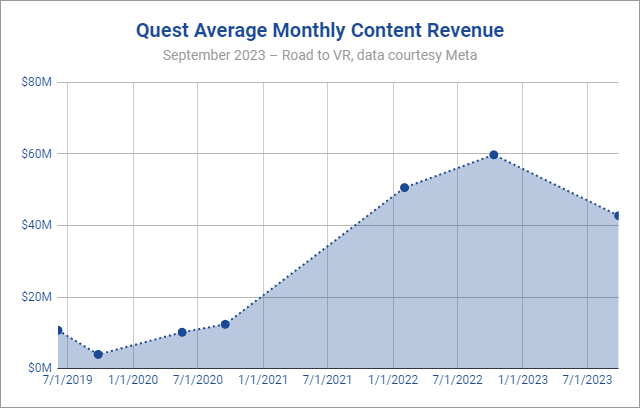

Meta revealed that Quest Store games and apps have generated over $2 billion in revenue as of October 2023. While the store is still earning for developers, looking at revenue over time shows that things have cooled off compared to prior years.

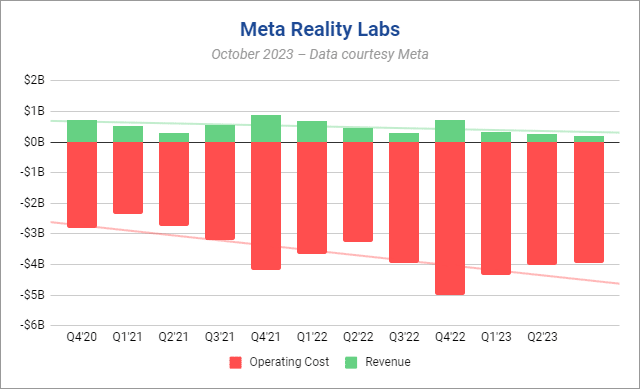

And despite being the leading force in XR today, Meta still isn’t even close to turning a profit overall from the investments it’s making in its XR division, Reality Labs. In late 2023 the division hit is lowest quarterly revenue since it began reporting that figure.

What it Means for 2024

As of its last quarterly update, Meta has spent a staggering $43.5 billion on Reality Labs. And even when you count what it has earned back, the division is still in the red by $37.5 billion. While many of those investments surely haven’t manifested into marketable products yet, there’s only so long that investors will tolerate investments that aren’t seeing near-term returns. And even for a nearly trillion-dollar company, $37.5 billion is nothing to sneeze at.

We won’t know for a while yet how well the 2023 holiday season looks for Reality Labs (Q4 has always been is strongest quarter), but my gut feeling is that it won’t be materially different when compared to the division’s track record overall.

Every quarter that goes by without Reality Labs justifying money spent will mean more pressure from investors. This puts Meta in a curious place… on the off chance that Vision Pro is a flop, it could be the last straw that makes the company’s investors fully turn against the existence of Reality Labs.

Purely from the perspective of the company’s other activities, Meta has yet to find real mainstream traction with its XR products. And with Meta’s continued struggles to make its XR services easy and appealing enough for the mainstream, there’s no reason to think that will change in 2024.

Valve Launches SteamVR 2.0 and Steam Link on Quest, Bolstering Rumors of a New VR Headset in the Works

The News

After a period of near complete silence about the company’s XR plans following the launch of its Index VR headset and Half-Life: Alyx, Valve busted back onto the scene in 2023 with the launch of SteamVR 2.0. This long-promised update went a long way toward modernizing the SteamVR interface while adding Steam platform features that were previously missing.

And not long after, Valve launched Steam Link on Quest, allowing customers an easy and direct pathway to play SteamVR content on their headset without going through the long-forgotten Oculus PC software layer.

What it Means for 2024

Valve works in mysterious ways and it has always been difficult to predict exactly what they’ll do next—there’s not a whole lot of software companies out there that also make VR headsets and handheld gaming PCs.

Valve’s latest moves have shown that the company hasn’t given up on VR. And that gives new meaning to its long-rumored follow-up to Index, which has become to be known as ‘Deckard’. Deckard is said to be a wireless VR headset that would stream games from either a host PC or dedicated VR console.

With sales of the company’s Index headset finally starting to wane in 2023, Valve may feel renewed urgency to get its rumored headset out the door sooner rather than later.

What were your biggest XR stories of 2023 and what do you think is coming in 2024? Drop a line in the comments to let us know!